The top business strategy tools that brokers need

Added 27/08/20 -

4

min read

With lockdown easing and the world of mortgages opening back up, now is the perfect time to plan next steps for growth and business resilience. As your business grows and develops, it’s vital to have the planning element in place. Particularly in light of recent events, it is pivotal that you have a plan to contend with any future changes.

There are many different tools out there to help you with planning your business, but starting with a business strategy framework will enable you to get started. These are some of the most popular tools available.

What are business strategy frameworks?

Business strategy frameworks are tools that help you analyse your business issues and structure your thinking around action points. These tools can help you better understand your business’ needs and communicate them to the company as a whole.

SWOT analysis

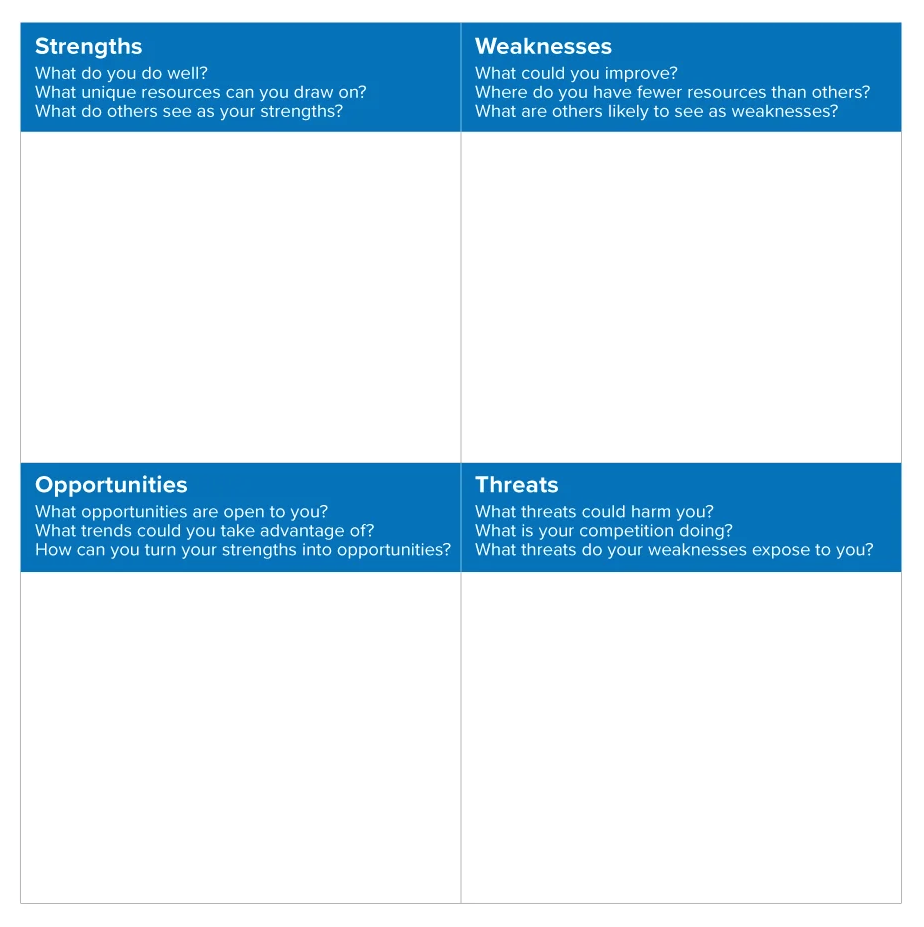

The SWOT analysis is the framework which stands out as the most familiar. It asks you to analyse the business based on its perceived Strengths (S), Weaknesses (W), Opportunities (O) and Threats (T).

It is arranged in a grid with four sections to help you better visualise the areas that currently carry the most weight. Here is an example:

Your business’ strengths are the things you do well, unique resources you have access to and what others view you to be good at. Your weaknesses are the opposite. This is where you list the things your organisation struggles with, resources you need more of and the areas that come across as weaknesses to others, or in comparison to your competitors.

For opportunities, consider the strengths and relationships at your disposal that you can turn into opportunities for growth. Perhaps there are avenues for finding new clients that you haven’t accessed yet or areas your competitors are not able to exploit. Lastly, threats. The threats are things that have the potential to harm you. Perhaps a competitor broker has started using resources that were previously exclusive to you or you notice that your usual client pool is drying up. A threat can also be something that if you don’t do soon, will damage the future of your business e.g. upgrade or implement technology.

Once you have all of this documented, you can start to connect patterns and come up with ideas to utilise strengths and opportunities and minimise weaknesses and threats.

The SWOT analysis chart is an easy first step into business strategy and gives you the tools to start recognising which actions should be prioritised.

Porter’s Five Forces

This tool was originally created by a professor at Harvard Business School to help analyse attractiveness and likely profitability. With this tool, you are asked to look beyond competitor analysis to consider five forces that make up the competitive environment for the industry, in this case, the mortgage industry.

These are the five forces in question:

-

Competitive rivalry

-

Supplier power

-

Buyer power

-

Threat of substitution

-

Threat of new entry

This force asks you to look at the number and strength of your competitors (this refers to other brokers and mortgage companies out there). Who are they? How do they compare to your service?

In most circumstances, supplier power refers to how easy it is for suppliers to increase their prices and the expense of switching suppliers. For brokers, this is more closely related to lenders, underwriters and the mortgage options available.

Buyer power refers to your clients. How much power do they have in this relationship? Are buyers able to dictate terms? How much influence do they have and how much does that affect the outcome for you and your business?

Importantly, the more clients you have, the less overall power individual clients can have over you.

The fourth force is the threat of substitution. This focuses on the likelihood of clients finding another way to do what you do. For brokers, the primary threat of substitution is the increasing usage of online mortgages. This is particularly important to consider in the current climate.

Understanding this force will help you to see ways of increasing value so that clients come to you instead of an automated service.

The final force that influences the competitive environment and how you can move within it is the threat of new entry. It’s important to consider how easy or difficult it is to enter the market as a competitor.

Because the world of finance is highly regulated, it can be a difficult entry barrier to breach. However, new entry can also include advisory firms newly integrating into the mortgage sector. The easier it is for new competitors to enter, the more effort you need to make to maintain and exceed your current market position.

The Ansoff Matrix

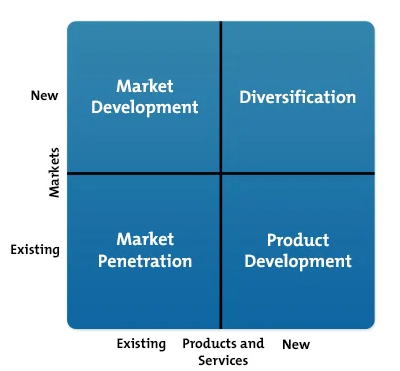

The Ansoff Matrix is a tool directly designed to strategise growth. Successful businesses understand that “business as usual” doesn’t stay usual forever, particularly in the current climate. Because of this, it is important to always be looking at how best to grow going forward.

To help you analyse the situation, an Ansoff Matrix can be incredibly helpful. The matrix outlines four possible areas for growth: market penetration, product development, market development, and diversification.

The matrix is divided into four quadrants and looks like this:

Using this layout, you’ll be able to easily identify the best route to growth for your business. Mind Tools has a great article breaking down the way to get the most out of this matrix.

There are many other strategic planning tools for business out there, these are just some of the most popular. When you are looking at your business strategy in the coming weeks and months, it’s important to search for the tools that suit your needs best. Hopefully, this brief introduction to strategy tools will help set you up for future success.

Get notified of new content

Related Content

.png)

2026 Mortgage Outlook: Regulation, Relationships and Real Opportunity

by Jeremy Duncombe

Added 08/01/26 - min read

.png)

Podcast #136 - Broker Talks: Why TikTok Belongs in Your Broker Toolkit

by Jeremy Duncombe

Added 05/01/26 - min read

.png)

The UK Mortgage Market: A Year of Progress, Pause and Potential

by Jeremy Duncombe

Added 18/12/25 - min read

Latest Blogs

.png)

2026 Mortgage Outlook: Regulation, Relationships and Real Opportunity

Added 08/01/26 - 3 min read

.png)

The UK Mortgage Market: A Year of Progress, Pause and Potential

Added 18/12/25 - 3 min read

.png)

Economics 101: A Calm Signal in a Noisy Market

Added 11/12/25 - 3 min read

Want to contribute to the Growth Library?

Get in touch with our Editorial Team here